Biden Administration Halted Student Loan Forgiveness Plan as Courts Issue Injunctions, Leaving Millions in Limbo

ByThe Biden administration's Saving on a Valuable Education (SAVE) plan was introduced to ease the financial burden on student loan borrowers by making payments more affordable and providing a faster route to loan forgiveness.

Enrolled borrowers, numbering over eight million, could see their monthly payments reduced significantly, with some paying as little as $0, depending on their income. The plan aimed to offer forgiveness after 10 years for those who borrowed $12,000 or less, and 20 to 25 years for others, reshaping the landscape of student loan repayment in the United States.

Legal Challenges and Judicial Orders

Despite the administration's confidence in its authority to implement SAVE, the plan faced significant legal challenges. Federal judges in Missouri and Kansas issued orders blocking further debt relief under SAVE and halting the implementation of additional provisions set to take effect on July 1. These rulings were a significant blow to the administration's efforts to reform the student loan system and provide lasting relief to borrowers.

The Missouri judge ruled that the administration lacked the authority to grant additional debt relief under SAVE, while the Kansas judge's order prevented the implementation of reduced monthly payments for undergraduate borrowers and the automatic enrollment of defaulted borrowers into the plan. These injunctions, though temporary, have thrown millions of borrowers into uncertainty about their repayment obligations and potential future relief.

Reactions and Implications

Consumer protection and debt-relief advocates expressed dismay at the rulings, highlighting the confusion and anxiety they have caused among borrowers. Mike Pierce, president of the Student Borrower Protection Center, criticized the orders as a "recipe for chaos," questioning the accuracy of bills, interest charges, and the fate of promised cancellations. He called for the Education Department to halt the student loan system until borrowers' rights under the law were clarified.

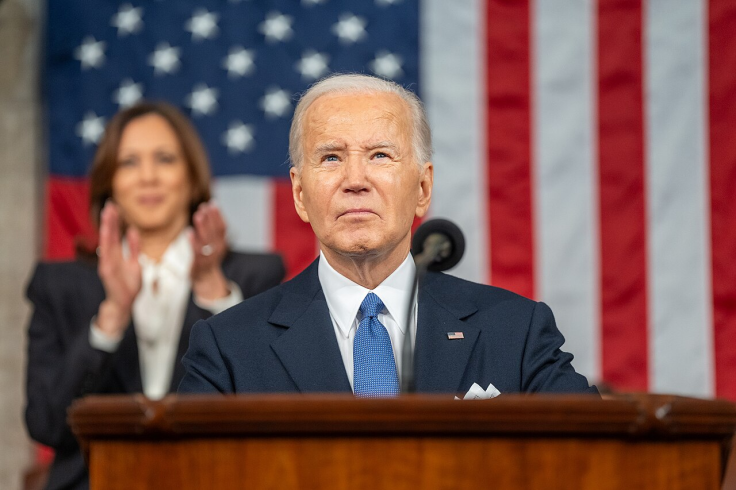

The Biden administration is expected to appeal the injunctions in an effort to preserve the SAVE plan, which has been a cornerstone of President Biden's student loan reform agenda and a key talking point for his re-election campaign. However, the path forward is fraught with legal and political challenges as the administration navigates the complexities of judicial rulings and potential legislative responses.

Political and Economic Consequences

The legal obstacles faced by the SAVE plan follow the Supreme Court's rejection of Biden's broader student loan forgiveness effort, which intended to cancel up to $20,000 in loans for over 40 million Americans. While SAVE was designed to provide more permanent relief compared to the one-time forgiveness effort, its future is now uncertain, potentially impacting millions of borrowers who had anticipated lower payments and eventual forgiveness.

Critics of the SAVE plan, including Republican lawmakers and state officials, argue that it constitutes an overreach of executive power and unfairly shifts the burden of debt onto taxpayers who did not attend college or who have already repaid their loans. U.S. Senator Bill Cassidy, a Louisiana Republican, denounced the plan as an irresponsible and cynical attempt to gain political favor ahead of the next election.

The financial implications of the SAVE plan are substantial, with the Congressional Budget Office estimating its cost at $276 billion over ten years. If fully implemented, it could transform the way higher education is financed, encouraging more students to utilize federal loans with the promise of manageable repayments and eventual forgiveness. However, the legal battles and political opposition suggest that achieving these goals will be a significant challenge.

As the Biden administration continues to advocate for student loan reform, the judicial rulings against SAVE underscore the contentious nature of this issue and the hurdles that lie ahead. Borrowers and policymakers alike will be closely watching the appeals process and subsequent legal developments to understand the future of student loan repayment in America.

The Biden administration's Saving on a Valuable Education (SAVE) plan was introduced to ease the financial burden on student loan borrowers by making payments more affordable and providing a faster route to loan forgiveness. Enrolled borrowers, numbering over eight million, could see their monthly payments reduced significantly, with some paying as little as $0, depending on their income. The plan aimed to offer forgiveness after ten years for those who borrowed $12,000 or less and 20 to 25 years for others, reshaping the landscape of student loan repayment in the United States

RELATED ARTICLE : Republican-Led States Challenge Biden's SAVE Plan

© 2025 University Herald, All rights reserved. Do not reproduce without permission.