How to Protect Yourself from Identity Theft in this Modern Age of Technology: Useful Tips for Every College Student

By

For most of the students, college years will be the first time they are going to live independently away from their parents. Leaving their usual routine will make these students interested in new experiences like having roommates and attending different on-campus events. Unfortunately, one thing that many may not be prepared for is to know how to properly protect themselves from identity theft.

As a parent, how can you help your son or daughter protect against the threat of identity fraud as they head off to college?

You can advise them to apply the following tips:

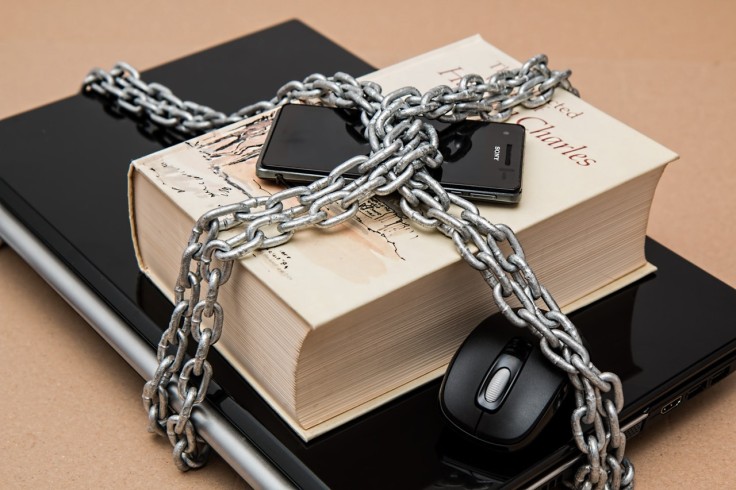

1. Protect Your Phone and Computer with a Password

For the past years, it has become a normal activity to store our personal information on digital devices. Make sure that your personal smartphone and computer are secure with a password. This is an effective way to protect yourself against easy access to your personal account and private information stored on your gadgets.

2. Beware When Browsing Unsecured Wi-Fi Networks

Who wouldn't love unrestricted access to the internet? Well, free Wi-Fi connection has become an expectation in most public places, especially inside the school premises. Avoid logging in to your personal accounts like email and online banking on unsecured wireless networks as much as possible. It's better to consider using VPN software on smartphones and computers to make secured connections when using open Wi-Fi networks.

3. Review Financial Statements Regularly

Having a financial statement doesn't mean that you have to be rich. It's as simple as the summary of your bank transactions. With the use of online and mobile banking, it's now easier to track every bank transactions from anywhere at any time. Make it a habit of regularly checking all the debits and credits to make sure that someone hasn't stolen your account information for fraudulent acts. Look for any purchases that you are not familiar with and notify your bank or credit card company if you recognize anything unusual.

4. Watch Out for Email and Phone Scams

Be vigilant before opening any email or answering phone calls that claim to be from banks or network companies asking you to log into a website that requires providing your personal information. Phishing emails and phone scams are the most common ways for fraudsters to trick innocent people into providing their personal information. Think and observe before clicking any links in these types of email or call back the company at their publicly listed phone number to confirm the said request.

5. Use Strong, Unique Passwords

Avoid using ordinary passwords, and don't use the same password for all accounts. Don't use words that are available in the dictionary. The combination of upper and lower case letters with numbers and symbols will generate a strong password. If you have to write down your passwords, don't just leave them on your desk or wallet. Remember to put asterisk instead of the last four characters so if anybody found it, they still need to encode the unknown pieces. There are also free or low-priced apps available that securely store all of those hard-to-remember passwords necessary for you to access your personal accounts. Then, the best way to protect your code is to not share it with anyone else. If perhaps there will be times you have no choice but to share it with someone, immediately change your password after their usage.

ALSO READ: Best Anti-theft Gadgets Every College Student Must Have

© 2025 University Herald, All rights reserved. Do not reproduce without permission.